EXPERIENCED ACCOUNTANTS

Making Tax Digital for Self Assessment – Full Compliance

Making Tax Digital for Self Assessment (MTD for ITSA) is one of the biggest changes to the UK tax system in recent years. Introduced by HM Revenue & Customs, MTD requires self-employed individuals and landlords to keep digital financial records and submit updates to HMRC throughout the year using approved accounting software. While the aim is to improve accuracy and reduce errors, the reality for many taxpayers is added pressure, unfamiliar systems, and confusion over ongoing reporting requirements.

Our Making Tax Digital for Self Assessment service is designed to remove that burden entirely. We take care of every aspect of MTD compliance, from initial registration and software setup to quarterly submissions and final declarations. Whether you’re transitioning from traditional Self Assessment or setting up digital systems for the first time, we ensure everything is handled correctly, efficiently, and in line with current HMRC regulations.

Understanding What MTD for ITSA Means for You

Understanding What MTD for ITSA Means for You

Under MTD for Self Assessment, eligible individuals can no longer rely on annual tax returns alone. Instead, you must:

Maintain digital records of income and allowable expenses

Use HMRC-approved accounting software

Submit quarterly updates to HMRC

Complete an End of Period Statement (EOPS)

File a final declaration confirming all income and tax due

For many sole traders and landlords, this represents a fundamental change in how tax is managed. Without professional support, mistakes can easily occur, leading to penalties, missed deadlines, or inaccurate tax liabilities. Our role is to guide you through these changes clearly, ensuring you understand what’s required while we handle the technical and administrative work on your behalf.

MTD Registration & HMRC Setup

One of the most common challenges with Making Tax Digital is knowing when and how to register correctly. Registering too early, too late, or incorrectly can cause serious issues with submissions and software compatibility. We manage the full registration process with HMRC, confirming your eligibility, setting up your digital tax account, and ensuring everything is aligned before your first submission is due.

We also act as your authorised agent, meaning HMRC communication is handled by us—saving you time and removing the stress of dealing with technical tax queries.

Digital Record Keeping & Software Support

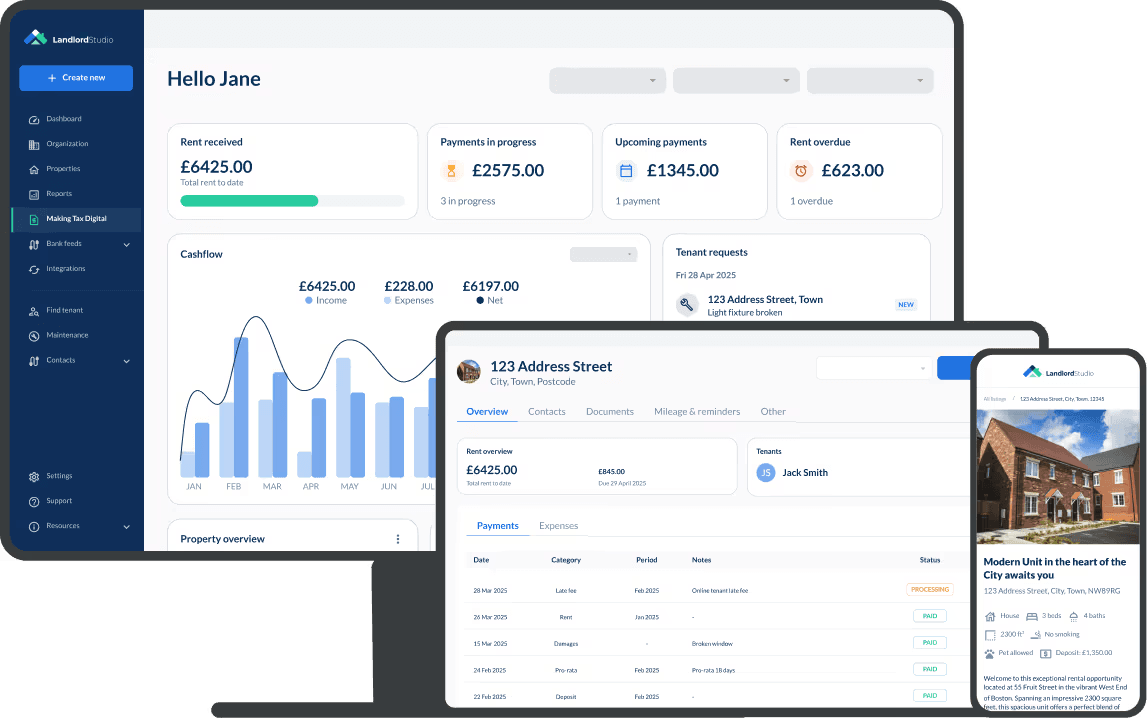

MTD requires accurate, real-time digital records, but not all software is created equal. We help you choose the right HMRC-recognised accounting software based on your business size, income streams, and level of experience. Once selected, we set everything up properly and ensure it integrates smoothly with HMRC systems.

Beyond setup, we provide ongoing support to help you maintain compliant records throughout the year. This includes:

Correct categorisation of income and expenses

Ensuring records meet MTD standards

Regular checks to prevent errors before submission

Guidance on best practice for digital bookkeeping

This proactive approach reduces the risk of mistakes and ensures your figures are always submission-ready.

Quarterly Updates & Ongoing Submissions

Get in touch with us today for further information

01273 044170

End of Period Statements & Final Declarations

At the end of the tax year, MTD still requires a formal review and confirmation of your figures. We handle your End of Period Statement (EOPS), making any necessary adjustments, claiming all allowable reliefs, and ensuring your records reflect your true tax position.

Once this is complete, we submit your final declaration to HMRC, confirming all sources of income and ensuring your tax liability is calculated accurately. Everything is double-checked to minimise risk and maximise compliance.

Who Our MTD for Self Assessment Service Is For

This service is ideal for:

Sole traders preparing for Making Tax Digital

Landlords with qualifying property income

Individuals struggling with digital bookkeeping

Taxpayers who want to avoid HMRC penalties

Anyone who prefers expert support rather than managing submissions themselves

Whether you’re digitally confident or completely new to online accounting, our service is tailored to your level of experience.

Why Use a Professional for MTD Compliance?

Making Tax Digital is not a one-off change—it’s an ongoing obligation. Without professional support, keeping up with deadlines, software updates, and reporting rules can quickly become overwhelming. By working with experienced accountants, you gain peace of mind knowing:

Your records remain fully compliant

All submissions are made accurately and on time

HMRC communication is handled for you

You receive proactive advice throughout the year

Most importantly, you avoid unnecessary penalties and gain a clearer, more controlled view of your finances.

Our YouTube Channel

Our Services

What we can offer

Bookkeeping

Click to view all services

XERO

Click to view all services

VAT Returns

Click to view all services

CIS Returns

Click to view all services

Happy to help you with all your accounting needs. Contact us today for more information.

Self Assessment Tax Returns

Click to view all services

Company Formations

Click to view all services

Company Accounts

Click to view all services

Corporate Tax Returns

Click to view all services

Proactive Tax Planning Under Making Tax Digital

One of the lesser-discussed benefits of Making Tax Digital for Self Assessment is the opportunity for proactive tax planning. Because your figures are reviewed and submitted quarterly, there is far greater visibility over your income and expenses throughout the year. When handled correctly, this allows for early identification of tax-saving opportunities rather than reacting once the tax year has ended.

As part of our MTD service, we don’t just submit figures—we analyse them. This enables us to highlight potential allowable expenses, timing considerations, and reliefs that could reduce your overall tax liability. By monitoring your financial position on an ongoing basis, we can help you plan for payments well in advance, improve cash flow management, and avoid unexpected tax bills. This forward-thinking approach is particularly valuable for seasonal businesses, growing sole traders, and landlords with fluctuating income.

MTD for Multiple Income Streams

Many individuals affected by Making Tax Digital do not have just one simple income source. It’s common to have a combination of self-employed income, rental income, and other taxable earnings. Managing multiple income streams under MTD adds another layer of complexity, particularly when records must remain digitally linked and compliant.

We specialise in handling MTD for individuals with more complex financial arrangements. Our service ensures each income stream is recorded correctly, reported accurately, and reviewed collectively to provide a full picture of your tax position. This prevents errors, duplication, or omissions that could trigger HMRC queries or penalties. No matter how straightforward or complex your income sources may be, we ensure everything is structured properly within your digital records.

Avoiding Penalties & Compliance Risks

HMRC has made it clear that compliance under Making Tax Digital is not optional once you fall within scope. Missed deadlines, incorrect submissions, or failure to maintain digital records can all result in penalties. Unfortunately, many taxpayers are unaware of just how easy it is to fall out of compliance without professional oversight.

Our MTD for Self Assessment service is designed specifically to minimise compliance risk. We monitor submission deadlines, review data for accuracy, and ensure all digital links meet HMRC requirements. By taking a preventative approach rather than a reactive one, we help you avoid unnecessary fines, enquiries, and disruption to your business or rental income.

Frequently Asked Questions (FAQs)

What services do you offer?

We provide a range of accounting services including bookkeeping, tax preparation, payroll management, and financial consulting.

How can I schedule a consultation?

You can schedule a consultation by calling our office, emailing us, or using the contact form on our website.

Do you offer services for individuals as well as businesses?

Yes, we offer tailored accounting services for both individuals and businesses.

What are your fees for accounting services?

Our fees vary depending on the service and the complexity of your needs. Contact us for a personalised quote.

Are your accountants certified?

Yes, all our accountants are fully certified and have extensive experience in the field.

How do you handle my confidential financial information?

We adhere to strict confidentiality protocols and use secure systems to protect your financial information.

Can you help with my tax returns?

Absolutely. We offer comprehensive tax preparation and filing services to ensure compliance and maximize your returns.

Do you provide accounting software support?

Yes, we can assist with setting up and managing various accounting software systems.

What industries do you specialise in?

We have experience in a wide range of industries, including retail, hospitality, construction, and more.

How can I contact you for support or questions?

You can reach us via phone, email, or through the contact form on our website. Our team is ready to assist you with any inquiries.

Maximizing Deductions: A Seasonal Guide for Small Business Owners

Effective tax planning is an ongoing endeavor that requires vigilance all year round. By strategically managing tax deductions each season, small business owners can optimize their financial strategies and significantly reduce tax liabilities. Regular consultations with tax professionals and leveraging the latest in accounting technology are crucial to ensuring compliance and enhancing financial decision-making. Embrace a proactive approach to maintain a robust financial status and support business growth

The Benefits of Hiring an Accountant for Small Businesses

Running a small business requires wearing many hats, from managing daily operations to ensuring customer satisfaction. However, one area that often demands specialized expertise is financial management. Hiring a professional accountant can transform how you handle your business’s finances. They not only ensure compliance with tax laws and regulations but also provide strategic insights that drive growth and profitability. By outsourcing accounting tasks, small business owners can focus on their core strengths while having peace of mind that their financial affairs are in capable hands.

Demystifying HMRC: Understanding the Basics of UK Taxation

HM Revenue and Customs (HMRC) plays a crucial role in the UK’s financial landscape, overseeing tax collection, customs duties, and benefit payments. Understanding HMRC is essential for individuals and businesses to navigate tax obligations effectively. This guide provides clarity on HMRC’s role, tax types such as Income Tax and VAT, and practical tips for interacting with HMRC to ensure compliance and financial security.

Navigating Tax Season: Essential Tips for UK Small Businesses and Individuals

Prepare for tax season with confidence and strategic insight with DD Accounting Ltd’s comprehensive guide. From understanding UK tax deadlines to maximizing your tax deductions, our expert advice is designed to navigate the complexities of tax season efficiently. Whether you’re an individual or a small business owner in the UK, discover how to manage your finances, anticipate payments on account, and seek professional guidance to optimise your financial strategy

Navigating the UK’s VAT Landscape: A Guide for Small Businesses

Understanding and managing Value Added Tax (VAT) can be one of the more complex aspects of running a small business in the UK. With regulations frequently changing and different VAT schemes to choose from, it's crucial to have a clear grasp of the VAT process to...

Self-Assessment Tax Returns: Common Pitfalls and How to Avoid Them

The self-assessment tax return is an annual ritual for many in the UK, including the self-employed, certain business owners, and individuals with various forms of untaxed income. While it's a fundamental aspect of tax compliance, it's fraught with potential pitfalls...