EXPERIENCED ACCOUNTANTS

Management Accounts – Clear Financial Insight to Drive Better Decisions

Management accounts provide regular, detailed insight into how your business is performing, far beyond what annual accounts can offer. While statutory accounts focus on compliance, management accounts are designed to help business owners understand profitability, cash flow, and trends in real time. Our Management Accounts service gives you the clarity you need to make informed decisions, plan ahead, and grow with confidence.

Whether you run a limited company, operate as a sole trader, or manage a growing trade business, management accounts turn raw financial data into meaningful information. Instead of waiting until year-end to assess performance, you gain ongoing visibility that supports proactive decision-making throughout the year.

What Are Management Accounts?

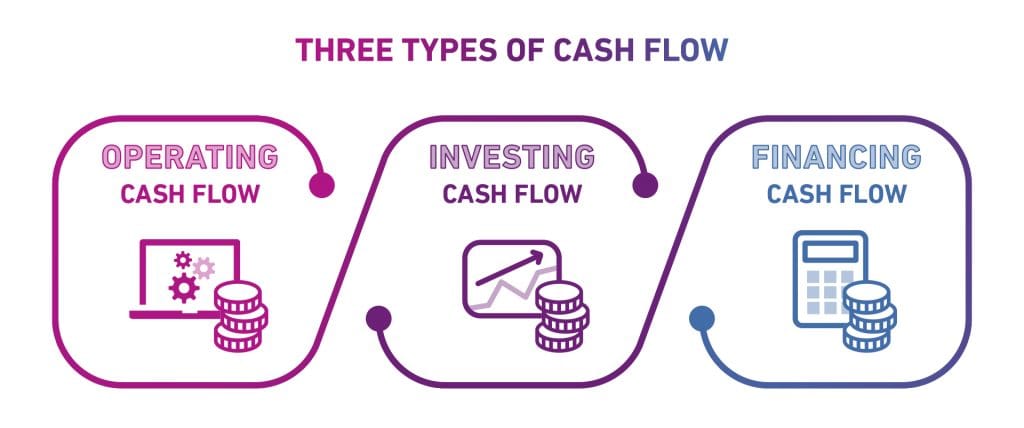

Management accounts are regular financial reports—typically prepared monthly or quarterly—that show how your business is performing during the year. They usually include profit and loss reports, cash flow summaries, and key performance indicators tailored to your business.

Unlike accounts prepared purely for HM Revenue & Customs or Companies House, management accounts are internal tools designed for you. They allow you to see where money is being made, where costs are increasing, and how financial performance compares to previous periods or expectations.

Profitability Analysis & Performance Tracking

Understanding profitability is about more than knowing your turnover. Management accounts break down income and expenses in detail, helping you identify which areas of your business are performing well and which need attention.

We analyse your figures to highlight trends, cost increases, and margin changes. This allows you to respond early—whether that means adjusting pricing, controlling costs, or reallocating resources. Regular performance tracking removes guesswork and replaces it with clear, reliable financial insight.

Cash Flow Visibility & Planning

Cash flow is one of the most common challenges faced by businesses of all sizes. Even profitable businesses can struggle if cash isn’t managed effectively. Management accounts provide a clear picture of cash movement, helping you understand when money is coming in and going out.

By reviewing cash flow regularly, we help you anticipate pressure points such as tax payments, VAT liabilities, or large expenses. This forward visibility allows you to plan confidently, avoid last-minute stress, and maintain financial stability throughout the year.

Tailored Reporting for Your Business

No two businesses are the same, which is why management accounts should never be one-size-fits-all. We tailor reports to reflect what matters most to your business, whether that’s job profitability, department performance, or cost control.

This tailored approach ensures the information you receive is relevant, easy to understand, and genuinely useful. Reports are presented clearly, without unnecessary complexity, so you can focus on decisions rather than deciphering figures.

Budgeting & Forecasting Support

Get in touch with us today for further information

01273 044170

Supporting Business Growth & Strategy

As businesses grow, financial complexity increases. Management accounts provide the insight needed to scale sustainably. Regular reporting helps identify when systems need to change, costs need controlling, or additional investment is required.

With up-to-date financial information, you can make strategic decisions with confidence rather than relying on instinct alone. This makes management accounts a powerful tool for long-term business planning.

Improving Decision-Making Confidence

Many business owners make decisions based on incomplete or outdated information. Management accounts replace uncertainty with clarity. By knowing your numbers, you can evaluate opportunities, manage risk, and act decisively.

This improved confidence benefits every aspect of your business—from pricing and staffing decisions to investment planning and growth strategies.

Management Accounts for Different Business Types

Our management accounts service supports:

Limited companies seeking ongoing financial insight

Sole traders wanting better visibility over profits

Trade businesses tracking job costs and margins

Growing businesses preparing for expansion

Reports are adapted to suit your structure and objectives, ensuring maximum relevance.

Our YouTube Channel

Our Services

What we can offer

Bookkeeping

Click to view all services

XERO

Click to view all services

VAT Returns

Click to view all services

CIS Returns

Click to view all services

Happy to help you with all your accounting needs. Contact us today for more information.

Self Assessment Tax Returns

Click to view all services

Company Formations

Click to view all services

Company Accounts

Click to view all services

Corporate Tax Returns

Click to view all services

Why Invest in Management Accounts?

Professional management accounts provide:

Regular insight into business performance

Improved cash flow control

Better planning and forecasting

Stronger decision-making confidence

Reduced reliance on year-end figures

They transform accounting from a compliance exercise into a strategic business tool.

Speak to a Management Accounts Specialist

If you want clearer insight, better control, and informed decision-making, management accounts are an essential investment. Our service delivers accurate, tailored reporting that supports confident business growth and long-term success.

Key Performance Indicators (KPIs) That Matter

Management accounts are most powerful when they focus on the metrics that genuinely drive your business forward. Key Performance Indicators (KPIs) turn raw financial data into measurable insights, allowing you to track performance against clear objectives.

We work with you to identify the KPIs that matter most to your business, whether that’s gross margin, overhead ratios, job profitability, or cash conversion cycles. By monitoring these indicators regularly, you gain early warning signs when performance shifts—allowing you to act quickly and decisively rather than reacting after problems escalate.

Monthly vs Quarterly Management Accounts

Not all businesses require the same reporting frequency. Some benefit from detailed monthly management accounts, while others prefer quarterly reporting aligned with VAT or operational cycles.

We help you determine the most effective reporting schedule based on your business size, activity level, and decision-making needs. Monthly reporting provides sharper insight and faster response times, while quarterly reports offer a broader strategic view. Whichever approach you choose, reports remain consistent, clear, and reliable.

Identifying Cost Leakage & Inefficiencies

Small, unnoticed costs can have a significant impact on profitability over time. Management accounts make it easier to spot inefficiencies, unnecessary expenditure, and cost creep that may otherwise go unnoticed.

By reviewing figures regularly, we help identify areas where spending can be tightened without harming operations. This may include supplier costs, overhead increases, or inefficiencies in specific areas of the business. Addressing these issues early improves margins and strengthens financial performance.

Frequently Asked Questions (FAQs)

What services do you offer?

We provide a range of accounting services including bookkeeping, tax preparation, payroll management, and financial consulting.

How can I schedule a consultation?

You can schedule a consultation by calling our office, emailing us, or using the contact form on our website.

Do you offer services for individuals as well as businesses?

Yes, we offer tailored accounting services for both individuals and businesses.

What are your fees for accounting services?

Our fees vary depending on the service and the complexity of your needs. Contact us for a personalised quote.

Are your accountants certified?

Yes, all our accountants are fully certified and have extensive experience in the field.

How do you handle my confidential financial information?

We adhere to strict confidentiality protocols and use secure systems to protect your financial information.

Can you help with my tax returns?

Absolutely. We offer comprehensive tax preparation and filing services to ensure compliance and maximize your returns.

Do you provide accounting software support?

Yes, we can assist with setting up and managing various accounting software systems.

What industries do you specialise in?

We have experience in a wide range of industries, including retail, hospitality, construction, and more.

How can I contact you for support or questions?

You can reach us via phone, email, or through the contact form on our website. Our team is ready to assist you with any inquiries.

Why Bookkeeping Backlogs Cost You More Than You Think — And How to Fix Them Fast

For many small business owners, bookkeeping is the task that gets pushed to “next week” again and again—until suddenly you’re staring at months of unrecorded expenses, missing receipts, unreconciled bank accounts, and unanswered queries from HMRC or your accountant....

The Smart Guide to Year-End Prep: How UK Businesses Can Stay Ahead of HMRC

For many business owners, year-end can feel chaotic: deadlines approach, paperwork piles up, and last-minute scrambles become the norm. But it doesn’t have to be that way. With the right preparation and a clear understanding of what HMRC expects, year-end can become a...

The Benefits of Monthly vs. Quarterly Bookkeeping Reviews

For small business owners, keeping on top of the books is a constant challenge. Between day-to-day operations, managing clients, and chasing growth, financial admin often falls to the bottom of the to-do list. However, regular bookkeeping reviews are essential for...

Year-End Accounts: A Checklist for Stress-Free Filing

For many business owners, year-end accounts can feel overwhelming. Deadlines, paperwork, and financial details all pile up, and without proper organisation, the process can quickly turn stressful. The good news is that with a clear plan and a structured checklist,...

How to Spot Early Signs of Cash Flow Trouble

Cash flow is often described as the lifeblood of a business, and with good reason. Even profitable companies can find themselves in financial difficulty if they don’t have enough cash available to cover everyday expenses. Spotting the warning signs early is the key to...

Tax-Efficient Ways to Pay Yourself as a Business Owner

One of the biggest challenges for small business owners is deciding how to pay themselves. Unlike traditional employees who simply receive a salary, business owners have several options—each with its own tax implications. Choosing the right method can help you...