EXPERIENCED ACCOUNTANTS

Sole Trader Accounting Services

Operating as a sole trader offers flexibility, independence, and simplicity, but it also comes with important financial and tax responsibilities. As a sole trader, you are personally responsible for keeping accurate records, reporting income correctly, and meeting tax deadlines set by HM Revenue & Customs. Without proper support, managing these obligations alongside running your business can quickly become overwhelming.

Our Sole Trader Accounting service is designed to remove that pressure. We provide clear, practical accounting support tailored specifically to self-employed individuals, ensuring compliance while helping you stay in control of your finances. Whether you’re newly self-employed or have been trading for years, our service adapts to your experience level and business needs.

Self Assessment Tax Returns for Sole Traders

Every sole trader must complete an annual Self Assessment tax return, declaring business income, allowable expenses, and any other taxable earnings. Accuracy is critical, as errors or omissions can lead to penalties, interest charges, or HMRC enquiries.

We prepare and submit your Self Assessment tax return accurately and on time, ensuring all relevant income is declared and every allowable expense is claimed correctly. Our thorough approach reduces risk while ensuring you’re not paying more tax than necessary. We also calculate your tax and National Insurance liabilities in advance, so there are no unexpected surprises.

Bookkeeping & Day-to-Day Record Keeping

Good bookkeeping is the foundation of stress-free sole trader accounting. HMRC requires clear, accurate records that show income and expenses, and poor record-keeping is one of the most common causes of compliance issues.

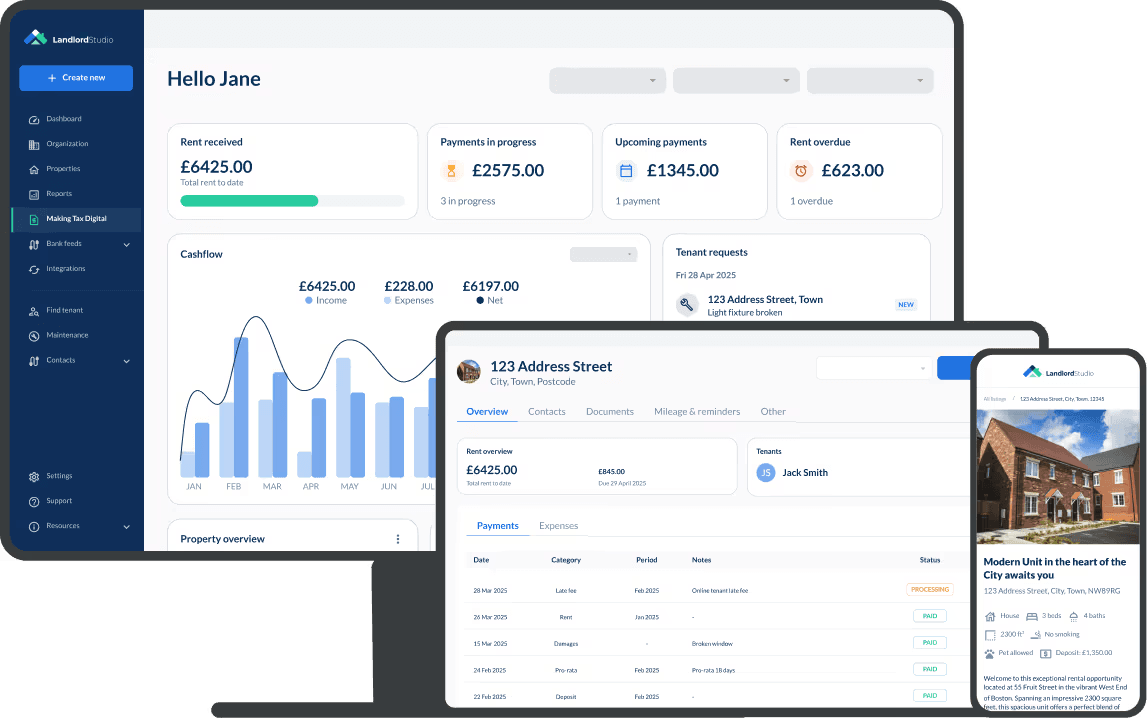

We support sole traders with ongoing bookkeeping, helping you maintain organised, compliant records throughout the year. This can include guidance on categorising expenses, tracking income correctly, and ensuring records are suitable for digital reporting where required. By keeping everything up to date, year-end tax returns become faster, smoother, and more accurate.

Allowable Expenses & Tax Efficiency

One of the key advantages of using a professional accountant as a sole trader is ensuring that all legitimate allowable expenses are claimed. Many self-employed individuals unknowingly overpay tax by missing expenses they are entitled to claim.

We review your business activity carefully to ensure all allowable costs are included, from office and travel expenses to tools, equipment, and professional fees. Where applicable, we also advise on capital allowances and timing considerations to improve tax efficiency. This proactive approach helps reduce your overall tax bill while remaining fully compliant with HMRC rules.

Making Tax Digital Support for Sole Traders

Get in touch with us today for further information

01273 044170

Support for New Sole Traders

Starting out as a sole trader can be daunting, particularly when it comes to understanding tax obligations and record-keeping requirements. Many new businesses struggle simply because they don’t know what’s expected of them.

We provide clear guidance for new sole traders, helping you register correctly with HMRC, understand your responsibilities, and set up compliant systems from the outset. This strong foundation helps prevent problems later and allows you to focus on building your business with confidence.

Cash Flow & Financial Awareness

As a sole trader, cash flow is personal. Tax bills, expenses, and income all directly affect your personal finances, making financial awareness especially important.

Our accounting support gives you a clearer picture of your financial position throughout the year. By understanding upcoming tax liabilities and monitoring income trends, you can plan ahead, budget effectively, and avoid last-minute pressure when payments fall due.

HMRC Communication & Ongoing Support

Dealing with HMRC can be time-consuming and stressful, particularly if queries or issues arise. As part of our service, we can act as your agent, handling HMRC correspondence on your behalf and responding to requests accurately and professionally.

Because we understand your records and tax position, we are well placed to resolve issues quickly and minimise disruption to your business.

Our YouTube Channel

Our Services

What we can offer

Bookkeeping

Click to view all services

XERO

Click to view all services

VAT Returns

Click to view all services

CIS Returns

Click to view all services

Happy to help you with all your accounting needs. Contact us today for more information.

Self Assessment Tax Returns

Click to view all services

Company Formations

Click to view all services

Company Accounts

Click to view all services

Corporate Tax Returns

Click to view all services

Why Choose Professional Sole Trader Accounting?

Professional accounting support ensures:

Accurate, compliant tax reporting

Reduced risk of penalties or HMRC enquiries

Improved tax efficiency

Less stress and more time to focus on your work

Our aim is to provide straightforward, reliable support that genuinely makes running your business easier.

Speak to a Sole Trader Accounting Specialist

If you want accounting support that’s clear, proactive, and built around your business, professional sole trader accounting makes all the difference. We handle the numbers, deadlines, and compliance—so you can concentrate on doing what you do best.

Industry-Specific Support for Sole Traders

No two sole traders operate in exactly the same way. A tradesperson, consultant, creative professional, or online seller will each have very different income structures, expenses, and reporting requirements. Generic accounting advice often fails to address these differences properly.

Our sole trader accounting service is tailored to your specific line of work. We take the time to understand how you earn income, what costs you incur, and how your business operates day to day. This allows us to apply the correct tax treatment, identify relevant allowable expenses, and ensure your records accurately reflect your activity. Industry-specific insight reduces the risk of errors and ensures your accounting genuinely supports your business.

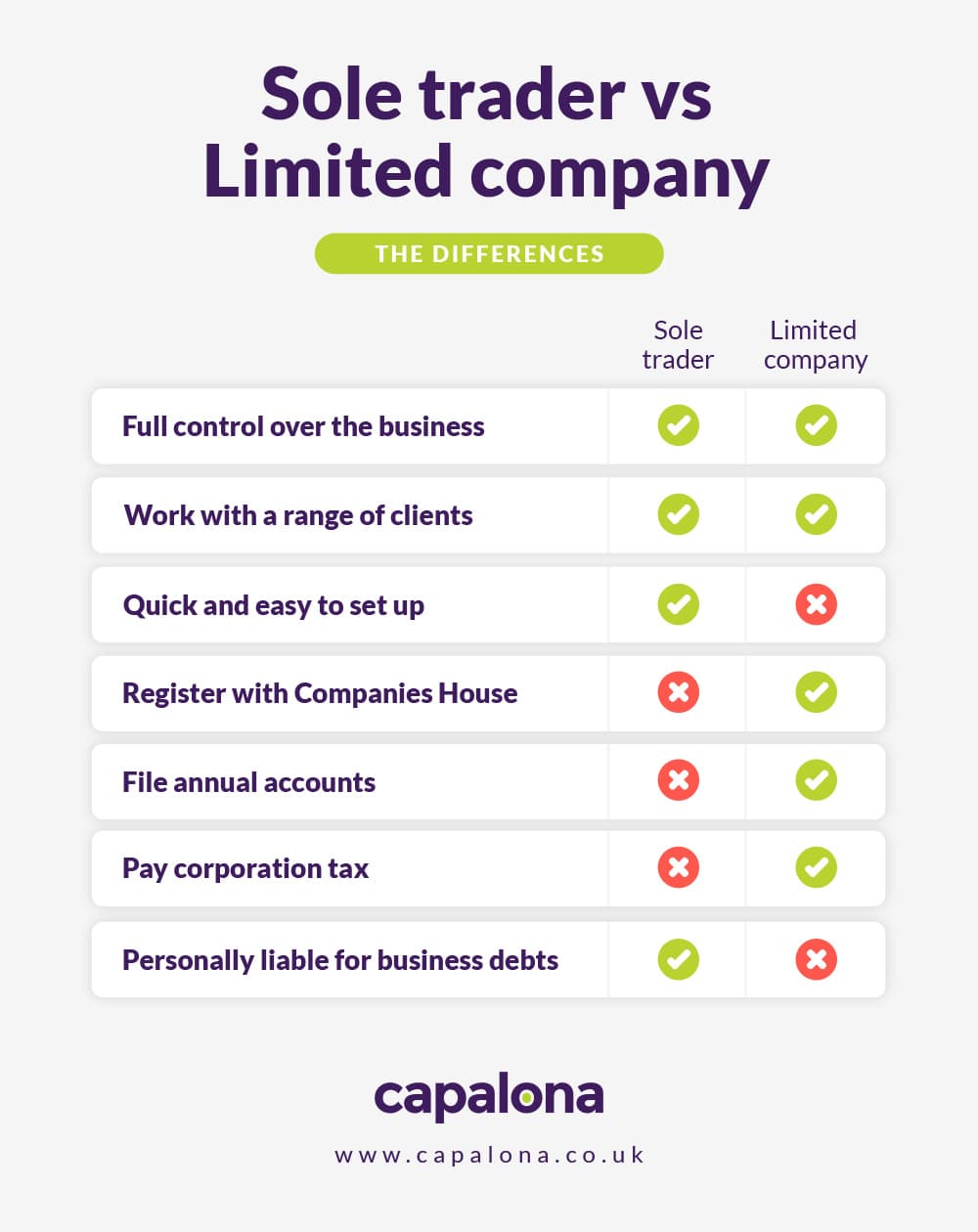

Personal Tax & Business Finances Combined

Unlike limited companies, sole traders do not have a legal separation between personal and business finances. This makes personal tax planning an essential part of sole trader accounting. Decisions made within the business can have a direct impact on your personal financial position.

We consider your full tax picture when preparing your accounts, ensuring business income, other earnings, and personal allowances are all accounted for correctly. This joined-up approach helps prevent issues such as underpayments, unexpected tax bills, or incorrect National Insurance calculations. It also provides a clearer understanding of how your business supports your personal financial goals.

National Insurance Contributions Explained

National Insurance is often misunderstood by sole traders, yet it forms a significant part of your tax obligations. Calculating the correct Class 2 and Class 4 National Insurance contributions requires accurate profit figures and up-to-date thresholds.

We ensure your National Insurance is calculated correctly and explained clearly, so you know exactly what you’re paying and why. This transparency helps you plan for payments and avoid confusion or errors that could lead to HMRC issues later.

Preparing for Growth as a Sole Trader

Many sole traders begin small but grow quickly. As income increases, tax obligations become more complex, and the risk of inefficiency rises if systems don’t evolve alongside the business.

Our service supports you as your business grows, helping you assess when changes are needed—whether that’s improved record-keeping, additional reporting support, or considering incorporation. By planning ahead, we help ensure growth remains sustainable rather than overwhelming.

Protecting Yourself From HMRC Enquiries

Sole traders are one of the most commonly reviewed taxpayer groups due to the nature of self-employment income. Poor records, inconsistencies, or late submissions can easily trigger HMRC enquiries.

By maintaining accurate, well-organised records and submitting compliant returns, we significantly reduce your risk of enquiry. If HMRC does raise questions, we provide professional support to respond promptly and accurately, minimising disruption and stress.

Frequently Asked Questions (FAQs)

What services do you offer?

We provide a range of accounting services including bookkeeping, tax preparation, payroll management, and financial consulting.

How can I schedule a consultation?

You can schedule a consultation by calling our office, emailing us, or using the contact form on our website.

Do you offer services for individuals as well as businesses?

Yes, we offer tailored accounting services for both individuals and businesses.

What are your fees for accounting services?

Our fees vary depending on the service and the complexity of your needs. Contact us for a personalised quote.

Are your accountants certified?

Yes, all our accountants are fully certified and have extensive experience in the field.

How do you handle my confidential financial information?

We adhere to strict confidentiality protocols and use secure systems to protect your financial information.

Can you help with my tax returns?

Absolutely. We offer comprehensive tax preparation and filing services to ensure compliance and maximize your returns.

Do you provide accounting software support?

Yes, we can assist with setting up and managing various accounting software systems.

What industries do you specialise in?

We have experience in a wide range of industries, including retail, hospitality, construction, and more.

How can I contact you for support or questions?

You can reach us via phone, email, or through the contact form on our website. Our team is ready to assist you with any inquiries.

Why Bookkeeping Backlogs Cost You More Than You Think — And How to Fix Them Fast

For many small business owners, bookkeeping is the task that gets pushed to “next week” again and again—until suddenly you’re staring at months of unrecorded expenses, missing receipts, unreconciled bank accounts, and unanswered queries from HMRC or your accountant....

The Smart Guide to Year-End Prep: How UK Businesses Can Stay Ahead of HMRC

For many business owners, year-end can feel chaotic: deadlines approach, paperwork piles up, and last-minute scrambles become the norm. But it doesn’t have to be that way. With the right preparation and a clear understanding of what HMRC expects, year-end can become a...

The Benefits of Monthly vs. Quarterly Bookkeeping Reviews

For small business owners, keeping on top of the books is a constant challenge. Between day-to-day operations, managing clients, and chasing growth, financial admin often falls to the bottom of the to-do list. However, regular bookkeeping reviews are essential for...

Year-End Accounts: A Checklist for Stress-Free Filing

For many business owners, year-end accounts can feel overwhelming. Deadlines, paperwork, and financial details all pile up, and without proper organisation, the process can quickly turn stressful. The good news is that with a clear plan and a structured checklist,...

How to Spot Early Signs of Cash Flow Trouble

Cash flow is often described as the lifeblood of a business, and with good reason. Even profitable companies can find themselves in financial difficulty if they don’t have enough cash available to cover everyday expenses. Spotting the warning signs early is the key to...

Tax-Efficient Ways to Pay Yourself as a Business Owner

One of the biggest challenges for small business owners is deciding how to pay themselves. Unlike traditional employees who simply receive a salary, business owners have several options—each with its own tax implications. Choosing the right method can help you...